Senior Citizen Saving Scheme Calculator

Senior Citizen saving Scheme (SCSS) Calculator: Calculate the maturity value and interest earnings.

Senior Citizens Small Savings Scheme is a Government backed post office small saving scheme.

By using the SCSS calculator you can easily calculate the value of your investment and the interest earned on the investment.

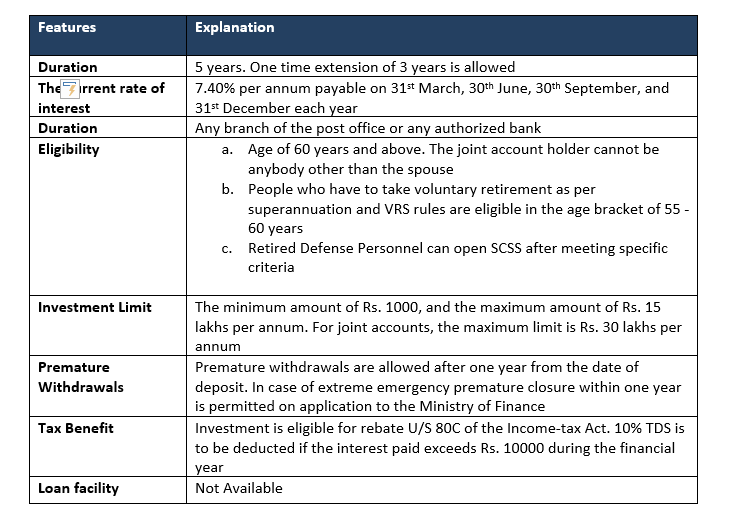

What is the Senior Citizens Savings Scheme (SCSS)? : Senior Citizens’ Small Savings Scheme is a Government backed small saving scheme which offers regular income in the form of interest on a quarterly basis. The maturity period of the scheme is 5 years extendable to 8 years. Currently, SCSS offers an interest rate of 7.40%. Under section 80C of In the come Tax Act, SCSS qualifies for tax exemption, but interest is taxable as per income tax slab. If the income is above Rs. 50000 then there is TDS on interest. SCSS scheme is available in post offices and banks. The minimum investment limit is Rs. 1000 and the maximum is Rs. 15000.

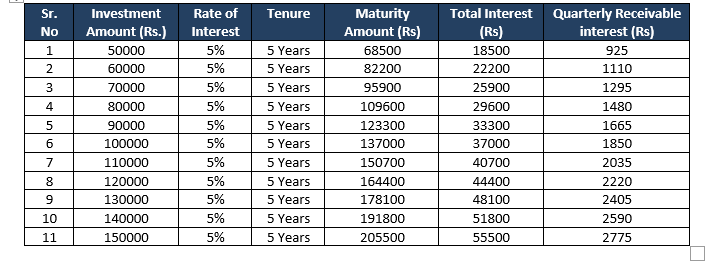

SCSS Calculation table

SCSS Key Features:

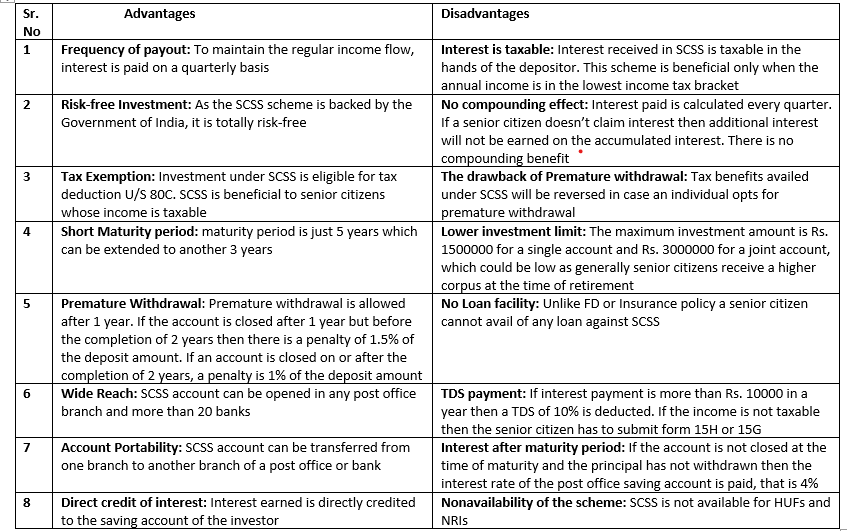

Advantages and Disadvantages of the Senior Citizens saving Scheme (SCSS)

How to use Senior Citizen saving Scheme (SCSS) Calculator?

Calculating the maturity amount, the total maturity amount, and the quarterly interest receivable is very simple in the SCSS calculator. Just enter the investment amount and within a fraction of a second, all the details will be generated automatically.

How can the SCSS calculator help you?

- SCSS calculator helps to compare interests on different investment amounts. It helps in future financial planning.

- As the SCSS calculator generates all the details in a fraction of a second it saves time. The rate of interest and the investment period is already fixed. You have to enter only the amount to be invested.

- The SCSS calculator is very accurate, there is no chance of error.