Kisan Vikas Patra (KVP) Calculator

Break-up of Total Payment

What is Kisan Vikas Patra?

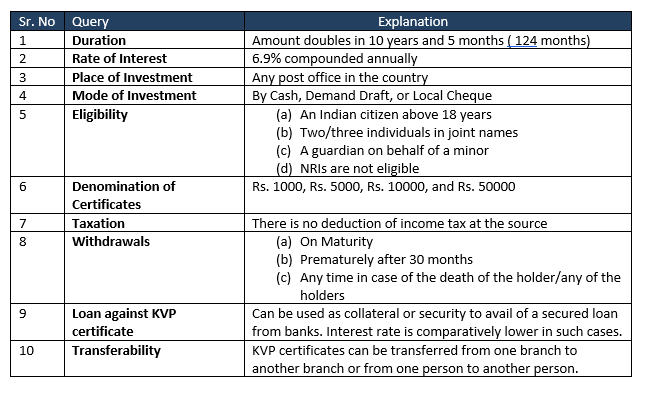

Kisan Vikas Patra is the most popular product of post office saving schemes, under this scheme the invested amount gets doubled at the time of maturity. Kisan Vikas Patra can be purchased from India Post for a minimum amount of Rs. 1000 and there is no limit for the maximum amount. The investment amount gets doubles after 10 years and 5 months (124 months). The rate of interest of KVP keeps on changing periodically as per the announcement of the Ministry of Finance. The current annual rate of interest is 6.9% for 124 months.

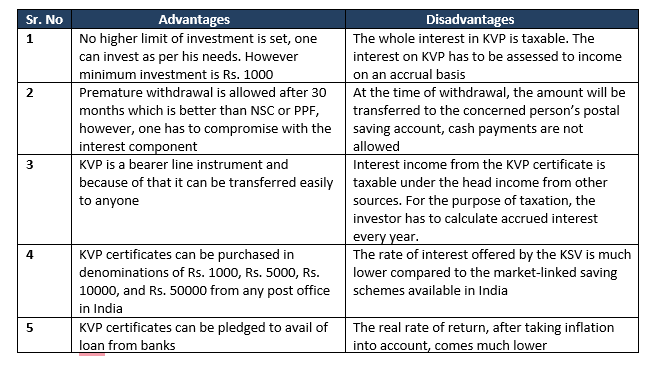

The whole interest in KVP is taxable. The interest on KVP has to be assessed to income on an accrual basis. However, the deposits are exempt from Tax Deduction at Source (TDS) at the time of withdrawal.

How to use Kisan Vikas Patra Calculator?

In order to calculate the maturity amount and maturity date you have to enter

- Investment amount and

- Investment date

Within a fraction of a second, you will get the date of maturity and your maturity amount.

Kisan Vikas Patra Key Features:

Kisan Vikas Patra Advantages and Disadvantages:

Whats Your Wealth Quotient?

you will be surprised!!!!